Market Update: 14 April 2020

As we adhered to our civic duty, staying indoors over the Easter Break in the hope to get out sooner than later – using Zoom to see our families or whatever can’t be hacked, the one certainty in this world is that Trump was not lying.

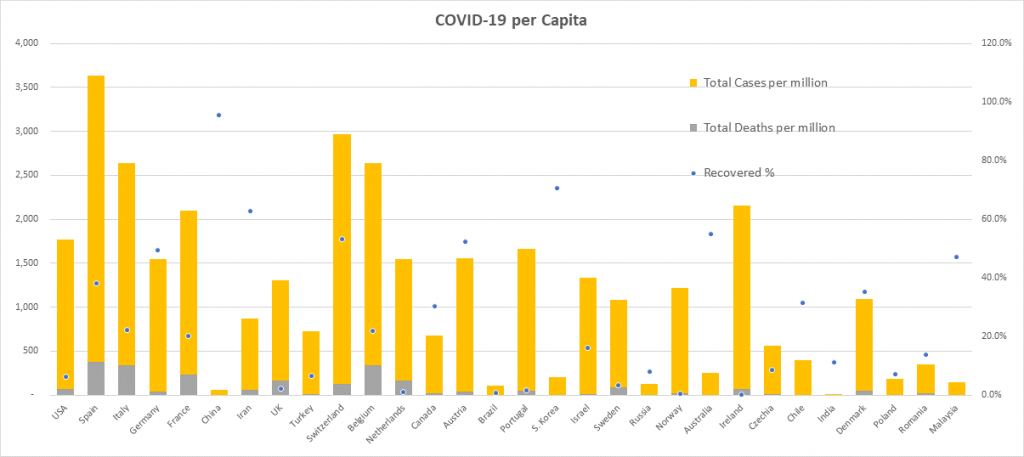

Trump said it was going to be a tough few weeks and indeed it has so far proven true with US now 3x more cases of COVID19 than Spain – although per capita, it’s 1/2 of Spain and now the US deaths are higher than that of Italy, again per capita it’s 1/5th the number of deaths.

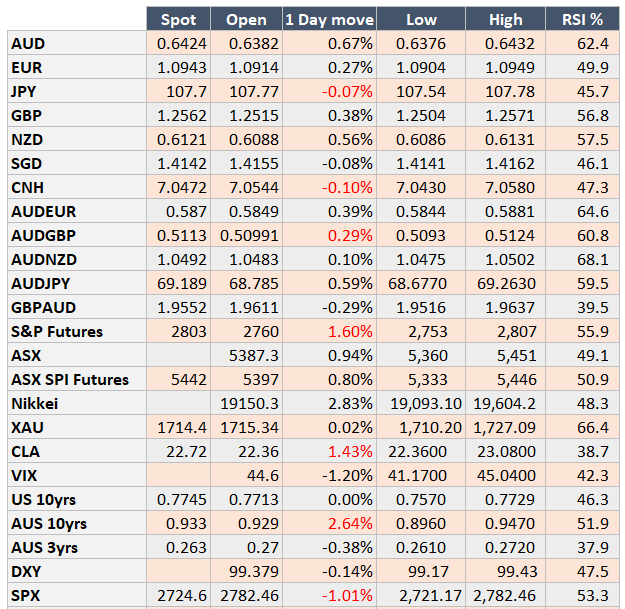

Why aren’t almost 2million cases (Bloomberg initially reported 2 million, then changed their mind) enough reason to warrant concern for AUD to fall rather than rally? We’ve already seen a high of 0.6432 today.

Here’s some flipside to consider:

- We’ve pored over the number of global cases peaking – had you been able to drive somewhere with the kids in the back to hear the ever-famous “are we there yet?”.. the answer this time is YES.

- Oil – the OPEC+ deal (with Mexico the late straggler), came to agreement on just under 10mil bpd cuts – this takes away some market volatility and thus permits an increase in risk taking i.e. long AUD.

- Governments are now talking exit plans – perhaps a dangling carrot, it could be weeks, it could be months – but to ensure we escape public unrest, it’s being talked about.

- We are one, but we are many – and we aren’t American. Australia has certainly peaked and cases per day are up in the 10’s … not 10,000’s like the US. Recovery rate is over the hump as well at 55%. Our mortality rate remains fortunately under 1% – that’s 1/4 of China, 1/12 of Italy. This means we could potentially open for business earlier than that of our American friends – as China has done. It’s more a comment on USD weakness.

- China may have come up with a Vaccine that it’s fast tracking trials on humans. We have heard this before, but the market will use any excuse at present.

- Easter – as with all public holidays are plain illiquid. Today will be the 1st day of liquidity to return.

Is it enough?

- The question of a sustainable rally is certainly upon us. Again back to the technicals and it’s coming up to a sell in S&P alongside AUDUSD. If the market is currently more driven by speculators (i.e. short term trading), then a sell will outweigh.

- Does that mean AUDUSD is going back to 55c? hmm maybe not. It does come down to liquidity – all Central Banks have made sure there’s plenty of it, so the catalyst for that type of move would be more due to prolonged closure of the economy than expected.

- Why could closures be prolonged? Look at Singapore, Japan and to a lesser extent China. The relaxation of laws caused a spike in cases… the world is watching for any hint of relapse.

- COVID data is important… but we now need to focus on economic data… business confidence is at an all time low, US earnings reporting won’t be pretty. Assessing the damage and the road ahead won’t be a straight line.

But as a whole, we do have some milestones to celebrate, but we aren’t yet out of the woods.

Contact the Inside Track Research Team for more info: +61 2 8916 6115