Market Update: 7 April 2020

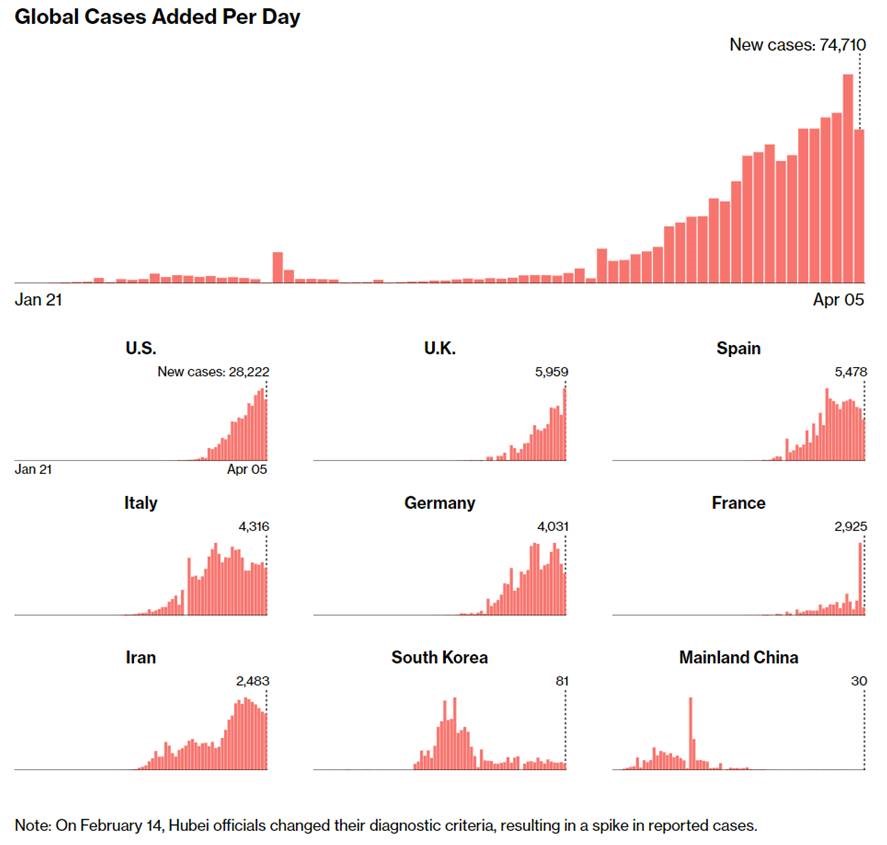

As US stocks continue yesterday’s rally up a further 4% to 7%, the assessment might be of euphoria as we look to see a (tentative) peak in new cases including those states hardest hit in the US. One would of course be dancing in the street – if you were allowed, but we seem to be in between the world of the optimists and pessimists.

The frontrunners to all events tend to be financial markets given liquidity, access to data and news to react swiftly. But we’ve left behind the doomsayers that tell us we can’t go outdoors until there’s a vaccine.. One headline that came out overnight was that Washington State schools were closed for the rest of the year. What they meant was the rest of the school year – i.e. re-commence in September. Some read this as the end of December as plausible. So maybe we’re just happy staying at home?

This kind of frontrunning and reality will eventually meet in the middle, but we don’t think we’re there just yet.

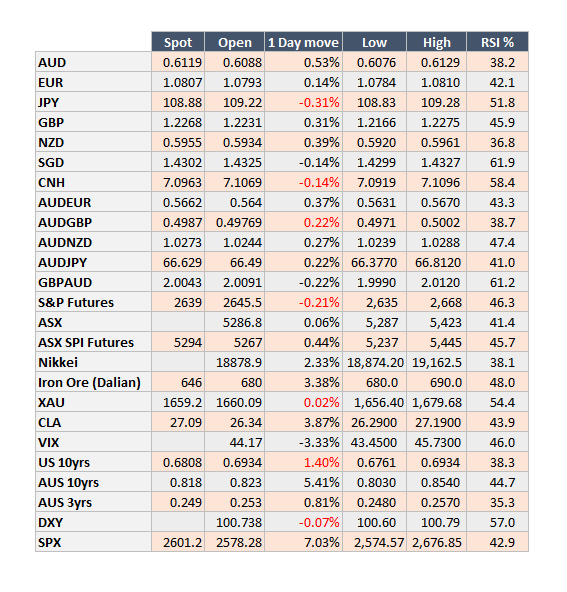

AUDUSD rallied from 0.5990 early open to 0.6122 as the US stocks continued their move. What was interesting though was Gold also rallied to near highs of 1679 – were they more aligned to the fate of Boris Johnson? It’s fair to say though Gold tends to be negatively correlated to S&P has shown positive correlation in the past few weeks (see chart below). It seems almost buying stocks and a put option at the same time… just in case.

RBA today… well they’ve run out of gunpowder but will give an assessment of the economy of now and future expectation. I wouldn’t be surprised to see them modestly upbeat or at least talking about green shoots, but they’re conservative by nature, so will also consider the prolongment of our closure.

Australia:

Contact the Inside Track Research Team for more info: +61 2 8916 6115