Market Update: 4 May 2020

This kind of question can be applied to multiple issues at present.. COVID-19, Isolation, market fall, market rally, market correction from the rally…

Again, the catalyst for the recent fall (or correction from the rally) was on both technicals and macro.. but what should happen in a “normal” market? In general, the macro moves can be a risk theme for quite some time and weigh on a particular currency/stock/bourse for a few weeks to a few months… think the evolution of Brexit.

But what can determine the current length of time before we see AUD back at 0.6570 may be more to do with a) market liquidity and b) monetary and fiscal policy. Sometimes they go hand in hand as policy can be the determinant of leverage and thus risk seeking.

What’s my point? for any macro manager that expected to make money off negative news prior to COVID-19, they’d have to act like a prop trader. in that the theme might last all of 24hours before the market shrugs things off and looks for the next distraction. It’s not to say it wouldn’t be a big move to the tune of 3-5%, but when the market is awash with leverage and no alternative for investment – i.e. you don’t put it in a bank account and wait for your savings to grow, you take on more risk to eek out an existence and maybe then some.

I don’t think we can simply shrug off COVID from here, but I do accept that the shorter-term players will simply think of this as a buy on dip opportunity until they’re proven wrong.

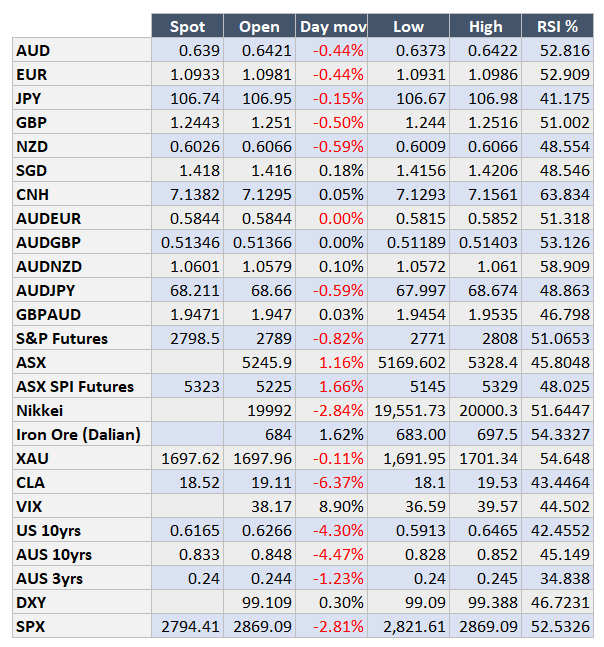

As we see VIX move back up to high 36’s, 10yr treasurys down to 0.61% safe-haven currencies like JPY outperform, the stars align for correction lower – but unless someone is still waiting on the sidelines to exit from longer term trades, it can be just another short term phase.

The ranges look compelling until we see either data confirming the bigger economic concerns or something of more substance than Remdesivir – not something that reduces days in hospital, but stops it from happening in the 1st place.

Contact the Inside Track Research Team for more info: +61 2 8916 6115