Market Update: 19 June 2020

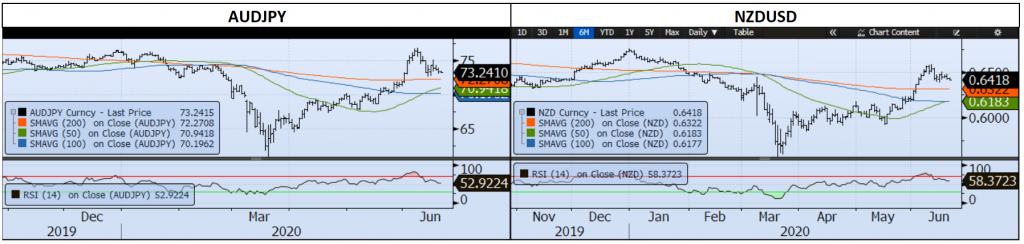

This week was a bit quieter in ways where the AUD took a breather, tested higher, tested lower and invariably landed where it started. We’ve thrown good and bad news at it, but here we are.

On the downside:

With Beijing going into lockdown in parts including schools and Texas, Florida and Arizona seeing spikes in COVID cases, we were certainly not expecting to test any new highs.

We also saw a pretty negative unemployment rate for Australia and again buffered by a fall in participation rate – yet still the unemployment rate moved higher than expected. For the record, ABS told us if we have a “normal” participation rate and without Jobkeeper assistance, we’d be seeing more like 9.6% unemployment – but again as our market oracle Derek Mumford tells us, for now, the markets seem to be looking 2years in advance – so historical data remains shunned. US initial and jobless claims also came out worse than expected (but not the same degree) and we saw poor UK GDP data.

On the upside:

Markets rallied on the Fed looking to buy Corporate bonds whilst China reduced its RRR to stimulate lending. In a way, the Beijing outbreak may also see China come out with more stimulatory measures.

Australia started Free Trade Agreement discussions with the UK and the UK pushed harder for agreements with the EU.

Despite the 2nd waves, these have remained limited to the known areas for the week and so it’s fair to say, it’s predominantly priced in.

Have a great weekend!

Contact the Inside Track Research Team for more info: +61 2 8916 6115