Market Update: 23 July 2020

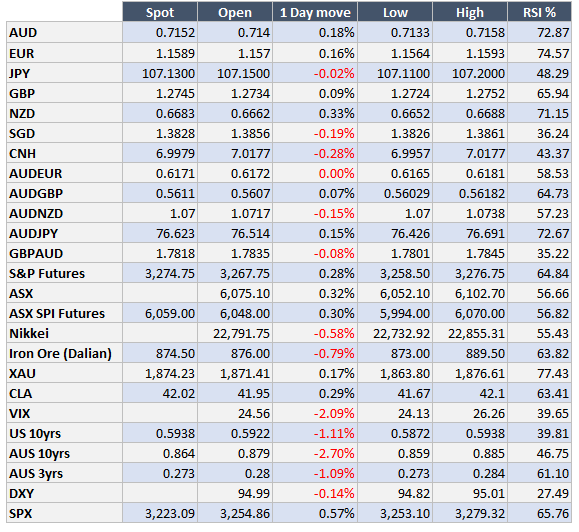

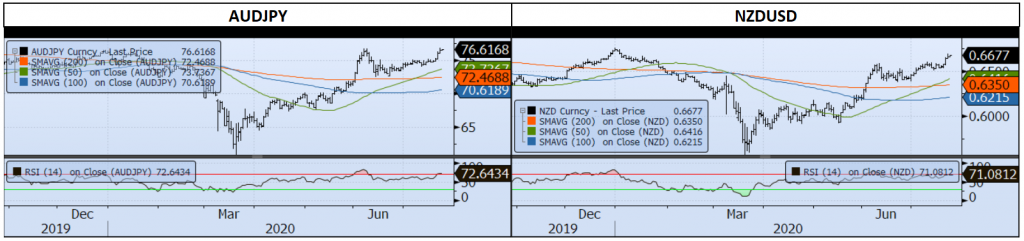

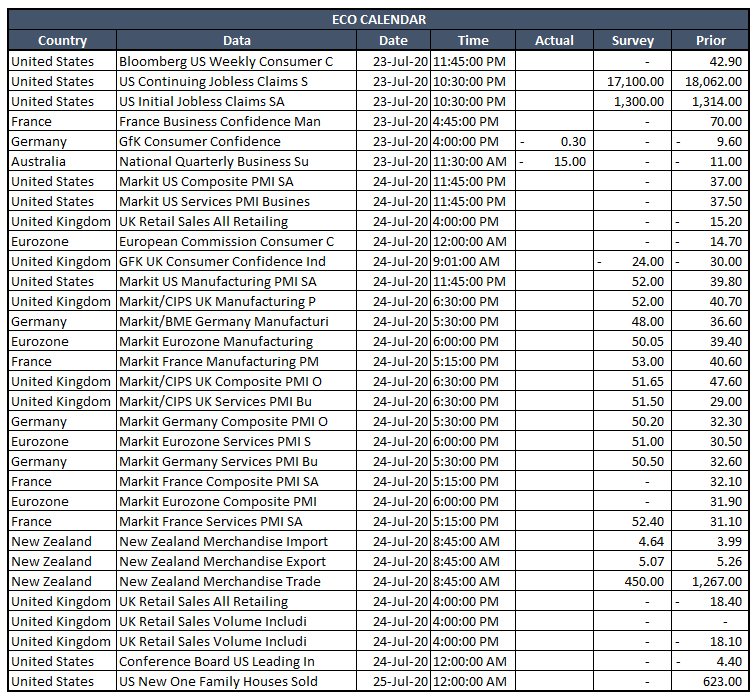

When you get everything you want, it should be a positive.. EU finally agreed upon a stimulus package, China talked about unveiling a fiscal package and Austalia extended their job keeper/seeker package – to a lesser amount. As such, AUD finally broke the shackles of the triangular/wedge formation and rallied to 0.7182.

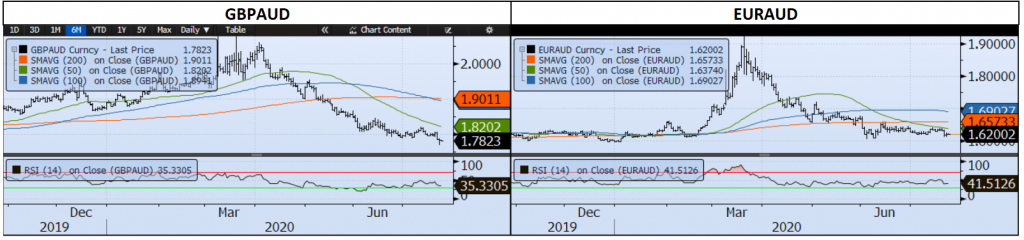

It wasn’t just a function of a risk rally as S&P is only modestly higher, it was more a technical move lower for USD across the board as they get sold to deploy around the world. The stimulus was just a catalyst for the stop loss triggers. GBP though fell on talk it won’t gain a EUR trade deal by year end.

But again we take a pause as the market acknowledges 15million COVID cases worldwide, 630k deaths and the likes of California seeing their highest single day increase in both cases and deaths. Of course locally, it’s not abating with Victoria again recording over 400 cases and mandatory masks. Does it just mean to those not affected, there’s more stimulus on its way?

Besides the euphoric news of another vaccine said to be successful in early trials, again the skirmishes between China and the ROW come to the forefront as the US tells China to close it’s Houston embassy on the concerns of hacking the vaccine-makers. It’s certainly a high-stakes game as the US just guaranteed Pfizer US3bln in orders before it’s even close going to market. In retaliation, China announced today a closing of a US consulate in Chengdu. If anything, we could breathe a sigh of relief if that’s where it stops.

AUD actually rallied to 0.7050 in response, but then China blacked out English Soccer in its spat with the UK – it’s just not cricket. It means though AUD downside risks linger whilst blue sky to 74c is plausible.

Contact the Inside Track Research Team for more info: +61 2 8916 6115