Market Update: 6 October 2020

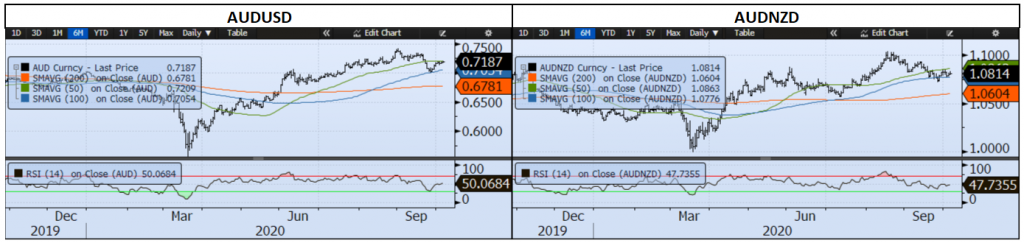

As the RBA announced no move and a light indication it will cut rates next meeting – on the same day as the Melbourne Cup (in whatever guise COVID allows), we can expect 15bps of cuts to 0.1% and perhaps a softer intent on AUD.

We now look a more important Budget though… why? because RBA have little bullets left unless they want to go into negative territory or find some other versions of QE (Quantitative Easing), but it’s very clear, they are now relying on Fiscal Policy to get us out of this mess.

So far what has been leaked is considered friendly enough for Labor to agree upon. They’ll make their usual soundings about the top end of the bracket not paying their fair share, but of course, the means testing for a lot of stimulus means it’s the 1st time they’ll see any direct benefit from the government – so perhaps some compromise in between.

As we see Trump back in the White House, markets have reduced risks of seeing a delayed election and as such, things will go back to the volatile normal. Despite most commentators seeing the 1st debate as a car crash, it would seem both just simply played to their caricatures – in other words, what their voting base wanted to hear. The swing voters probably became more confused – so it will be interesting if Trump tries a different tactic next debate. Betfair has Biden as a clear favourite – but I don’t think the markets have this fully priced in. The recent equity correction has of course given some allowance.

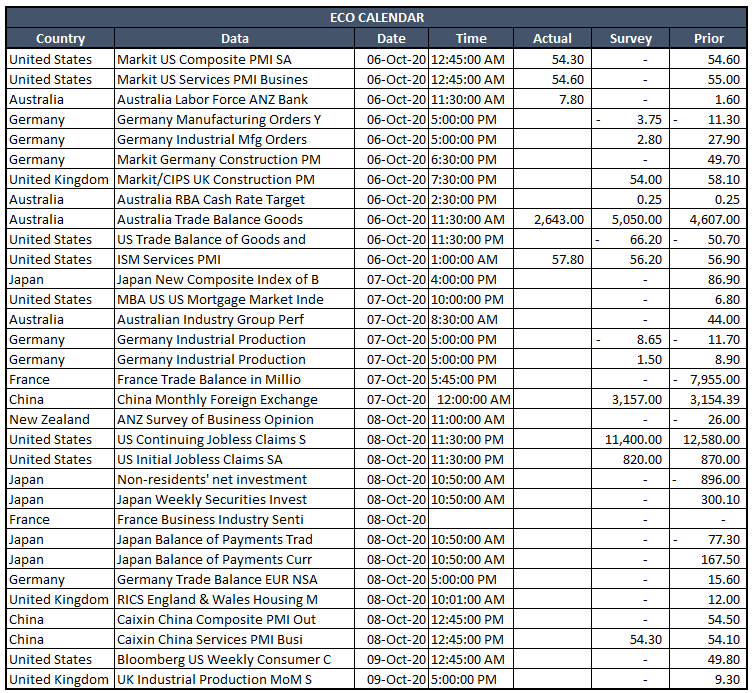

Not too much on the data front… German IP and usual US jobless claims. With tonight’s budget and the continued push for UK and Europe trade deals before the 15th, there’s still quite an interesting week to consider.

Contact the Inside Track Research Team for more info: +61 2 8916 6115