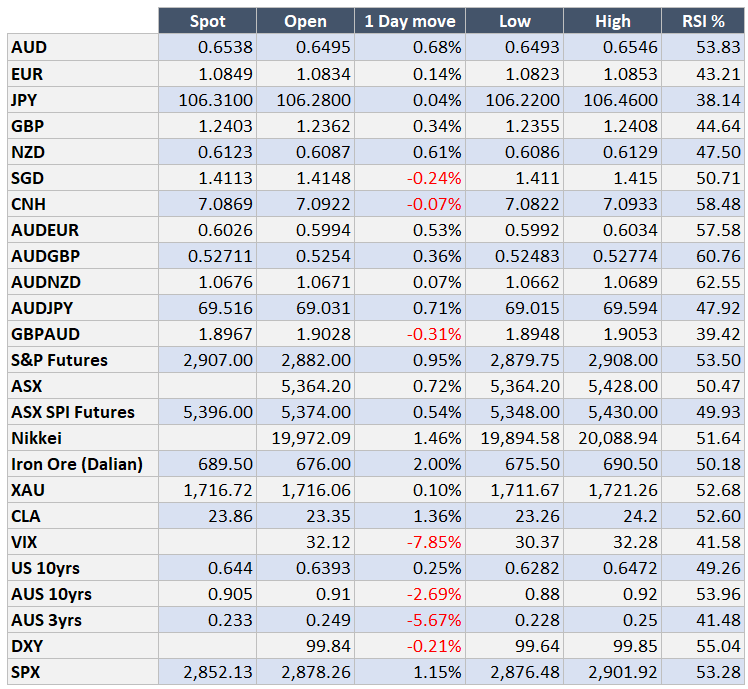

Market Update: 8 May 2020

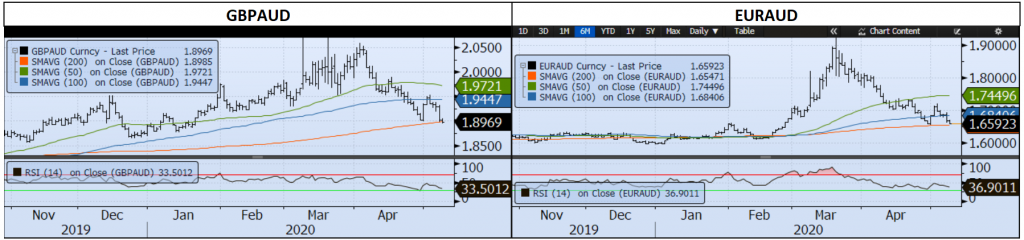

When US-China relations look strained, the markets get concerned – but any sign of hope sees a bounce as we saw overnight as talks over the trade deal are expected to go ahead next week. Is that hope only a tweet away from decimation?

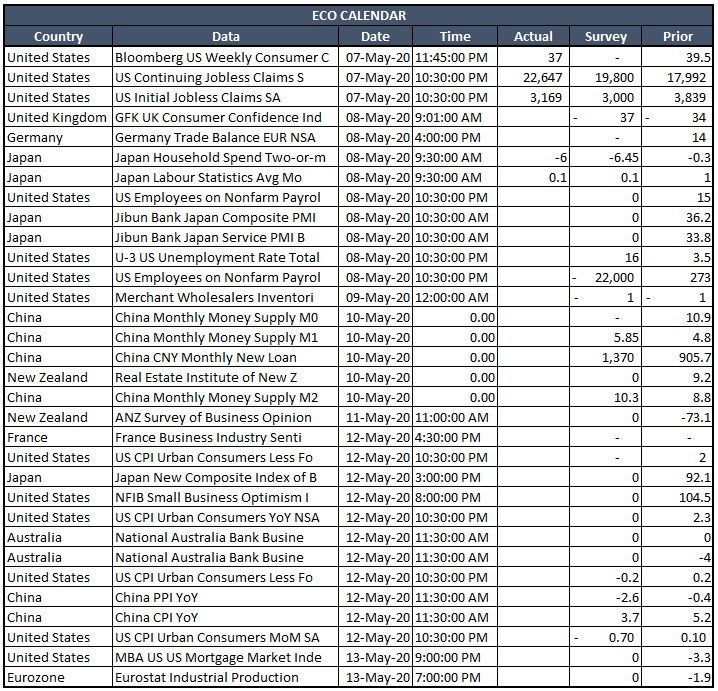

Sometimes optimism is blind – as poor French data was shrugged off, US treasuries fell again as did Oil, not to mention the shock jobless and continuing claims numbers – but yet S&P is higher… even Nasdaq is above its 2020 open. Interestingly even a Fed member said they didn’t know anyone who thought this would be a V shape recovery (perhaps though their Zoom skills are lacking?).

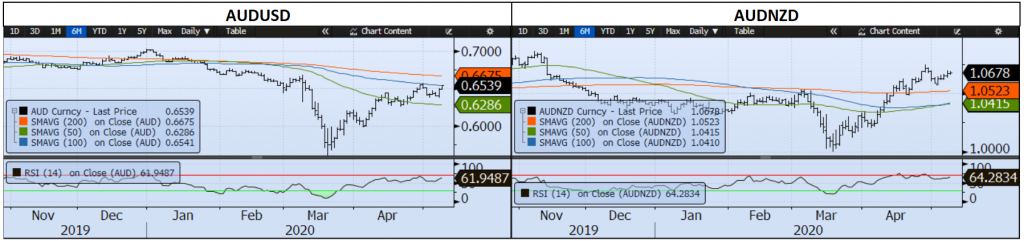

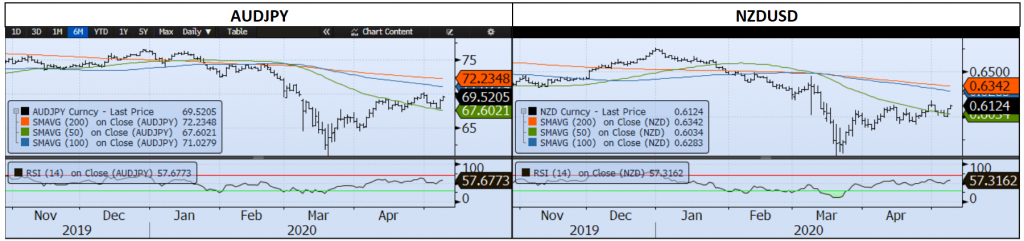

We saw reinforced pessimism from the RBA today from their Statement of Monetary Policy and we have US payrolls tonight for April – expecting -22 million (not a typo) and unemployment to be at a massive 16% but it almost seems these sticker shock numbers don’t matter now… but watch for May and June numbers to see if the markets can hold onto hope.

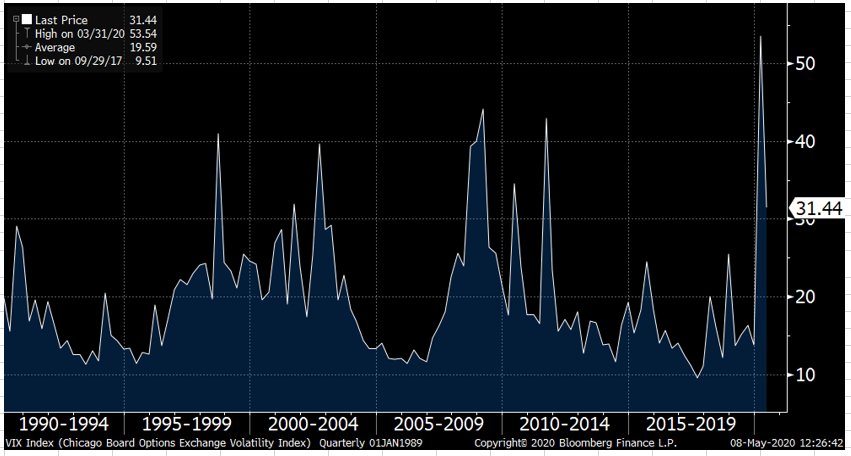

So the markets live on a knifes edge – all ready to react upon a tweet or a headline or anything that gives a slight glimpse into the future. It explains how VIX remains above 30 and it wouldn’t surprise if it held up here for a bit longer.

VIX (Volatility Index) remained above 30 for a year during the GFC.

Contact the Inside Track Research Team for more info: +61 2 8916 6115