Market Update: 1 May 2020

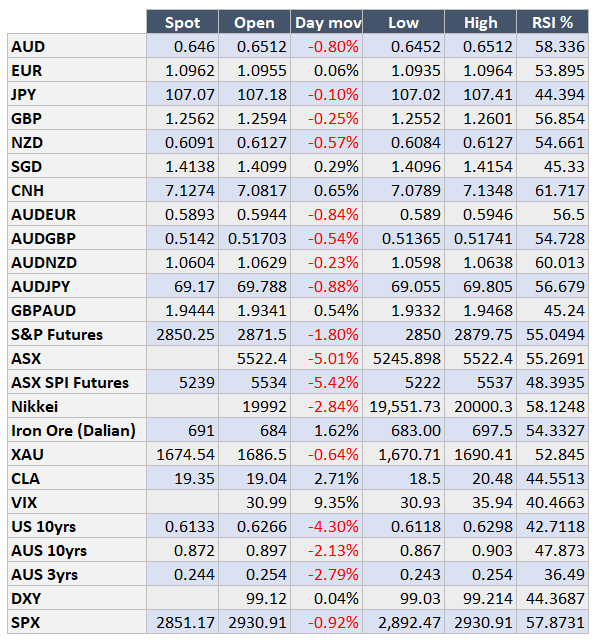

That adage is certainly working thus far as corrections in AUDUSD and its crosses alongside S&P fell.

Initially, this was predicated on poor European data but markets continued the sour tune after earnings came out poorly and then Trump came over the wires, pushing back on China and threatening tariffs – a news story goes further alluding to COVID-19 being manufactured in a Wuhan lab, plausibly canceling debt owed to China and stripping China of its sovereign immunity – i.e. it can then be sued by the public.

Yes, this is the epitome of brinkmanship and the outcome is less predictable than AUD. These words will certainly incense President Xi and will blockade both progress for the existing tariffs to be reduced, let alone global trade and the desired recovery from this pandemic. Australia has for right or wrong, thrown its hat in the ring on this and can also affect trade exports to China – should we be perceived as taking sides.

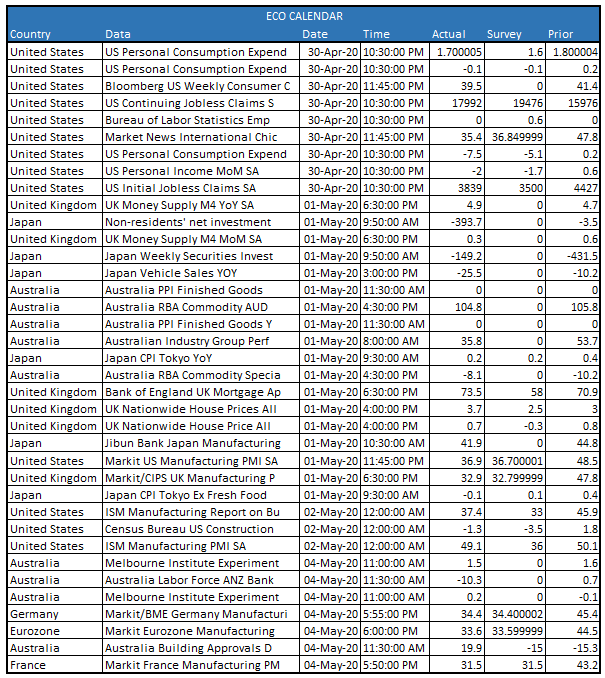

We have the RBA next week and should get an understanding how they perceive our battle against COVID is going. You would expect some upbeat words, but still caution on any fast improvement in the economy. They don’t really have anywhere to go in interest rates, so perhaps can suggest taking lead from RBNZ in relaxing macro-prudential regulations.

Despite the headline being relevant today… it is a known investment strategy – perhaps for those in the Northern Hemisphere to take a holiday (unsure where they could go at present). I’ll stick to my RSI’s that told me GBPAUD was oversold!

Contact the Inside Track Research Team for more info: +61 2 8916 6115