Market Update: 13 May 2020

Normally neither would be able to move the markets, but the US equivalent of our Chief Medical Officer Dr Anthony Fauci managed to bring AUD down by cautioning reopening the US economy too soon more than news of China stopping some beef exports by 4 abattoirs in Australia… but what has greater impact?

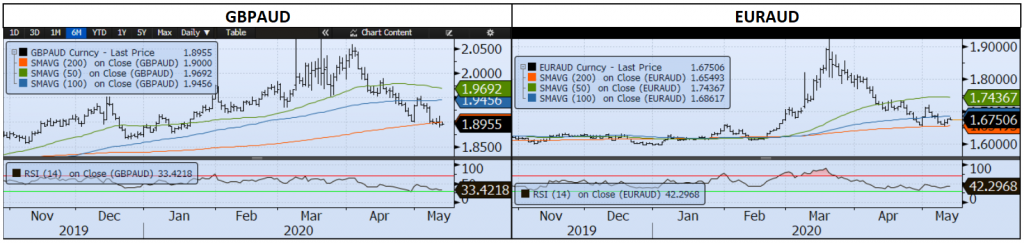

Realistically, both are suppressive for AUD trade and it comes down to how long either will run its course. COVID is well priced in, but a delay in reopening the world’s biggest economy can in turn hurt global trade. Conversely, beef exports by these abattoirs combined make up 35% of beef exports (or an expected AUD1Bln) – it is though the concern that China policy won’t stop there given the Barley tariffs being introduced. In other words, over AUD 200Bln of exports to China is at risk if you believe it’s not a quarantine issue and more political revenge on our Govt’s recent comments. So given our largest trading partner is China and should the US consume less, it wouldn’t be as detrimental to the economy as trade war with China. Nonetheless, AUD is lower for both reasons despite AUD initial rally overnight. AUD unable to test higher does open up the door to try the downside.

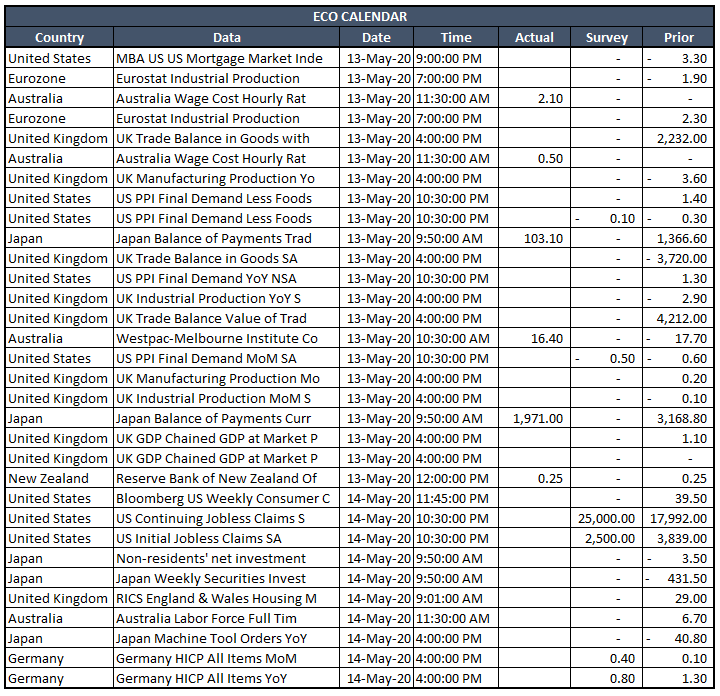

RBNZ today as usual causing volatility for NZD.. lows of 0.6000 pushing AUDNZD all the way back to 1.0777 as they talk about negative interest rates. This comes despite their own forecasts holding at 0.25% for Q1 2021 – so much that Bank Bills for Jun ’21 moved to negative. The obvious question is why would you wait if so bearish?

In another stoush of the titans.. Tesla have been told by Alameda County (California) they can restart operations if they follow guidance after Musk threatened to leave (or sue or be taken to jail). This now moves to a litigious precedent for the US should other companies want to take on authorities.

Contact the Inside Track Research Team for more info: +61 2 8916 6115