Market Update: 4 September 2020

OK the news reporters love a good market rout to sell their story… it brings interest, revenue and can be given a follow-up story to gain more advertising opportunities. Bottom line, we knew a recession was inevitable – like death and taxes. It’s almost akin to a bushfire – it can be absolutely devastating (and I take neither lightly), but it also creates the opportunity for rebirth.

This recession is of course different as it wasn’t anyone’s fault – thus the government and central banks are keen for us to look past it by throwing a tsunami of stimulus our way. We then as investors may gain a positive sentiment and not just consume again, but also invest into something other than a piggy bank.

With this in mind, we’ve talked before about the V-shaped market recovery being different to the economy. That still rings true… but as we see globally, you can price to perfection. Inevitably though, you have to take a step back and reassess when the economy gets back up to support the exuberance.

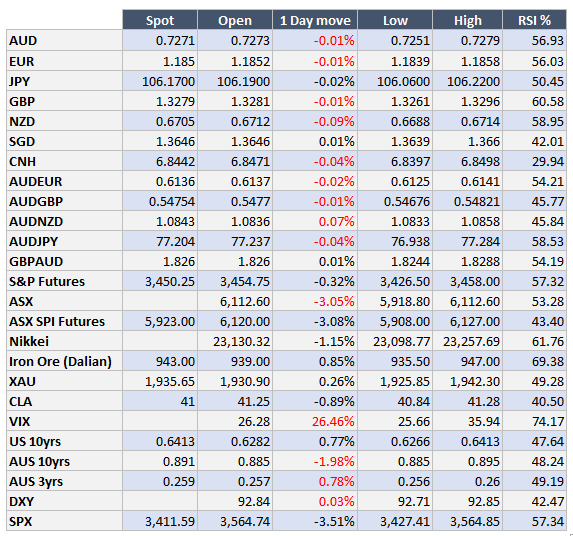

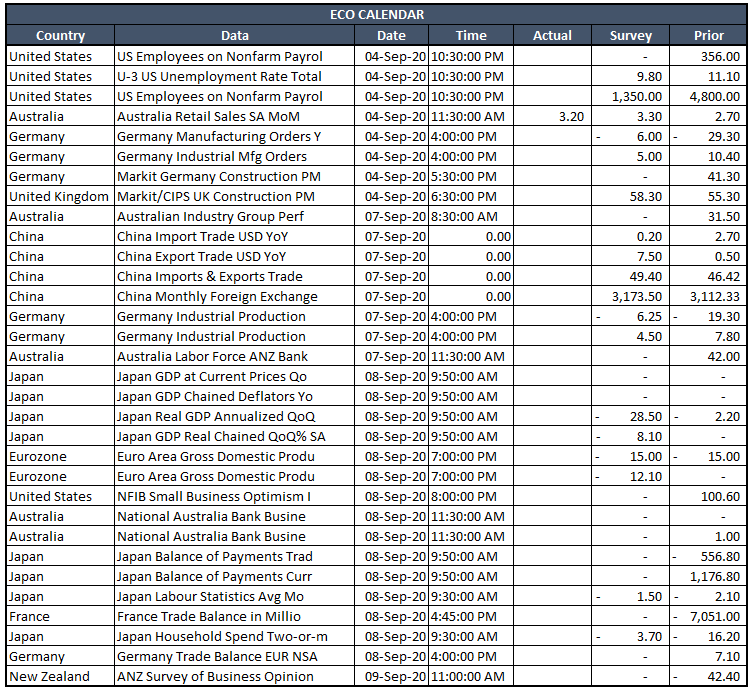

Perhaps you sell S&P stocks that have gained 64% since March lows – because hey, there’s Non-Farm Payrolls tonight and that can move the market either way. But now we are down 4% in S&P futures…. maybe that’s enough of a correction/recession for now? same for AUD.. from 74c to 72c. Maybe this kind of recession also brings opportunity?

Good luck tonight, have a great weekend and most importantly Happy Father’s Day!

Contact the Inside Track Research Team for more info: +61 2 8916 6115