Market Update: 27 April 2020

Things are chugging along in way of COVID cases falling across the globe – we’ve got this isolation thing sorted and the markets are rewarding the effort with a higher S&P and AUD.

What still keeps macro players up at night is the moment isolation finishes and the world realises things aren’t going to be the same. The case in point is the flouting of rules at numerous beaches as social distancing is somehow forgotten – it can then wreak havoc and force re-closures as it has done in Singapore and HK.

Then there’s earnings… NAB announced cash profits down 51% and a capital raise of 3.5Bln, this doesn’t bode well for the other banks nor it’s desire to lend. This is where concerns rise.

But on the other hand, Australia is now at a phenomenal 83% recovery and though a tragedy, a relatively low mortality rate. E.G. 1.24% vs the UK 13.56%. It is this that the market are looking at … we’re talking about international flow, so some domestic issues are going to be overlooked. The short-term traders have no inclination to worry about reality in 3months, it’s just the dream that counts.

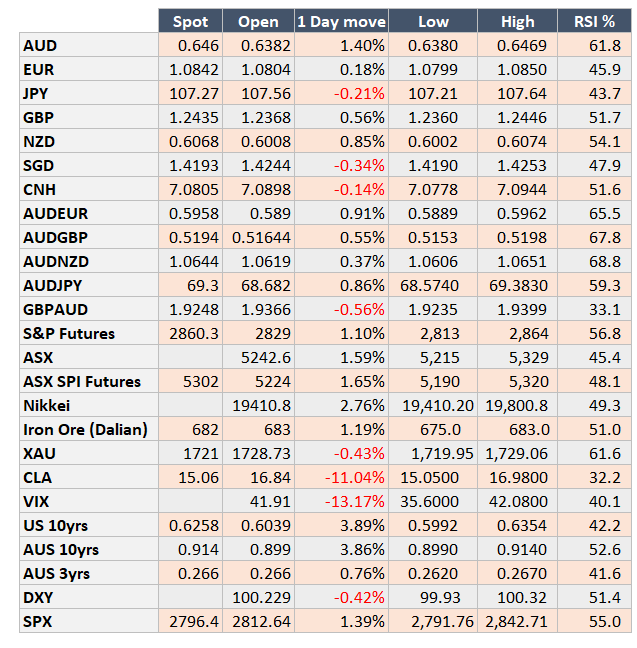

Until a shock is around the corner, AUD will persist higher as it has done today, taking out new highs. Shocks like Oil are starting to be overlooked (-10%), but again it’s more a problem for the US and USD as a whole is being sold.

BOJ announced a policy to buy an unlimited amount of JGBs alongside J-REITS and ETFs for the time being.. markets normally punish when they don’t see shock and awe, but allowed this to go past the keeper as it wasn’t perceived as too big a change. We have ECB and Fed to follow but there’s also less expectation for shock and awe.

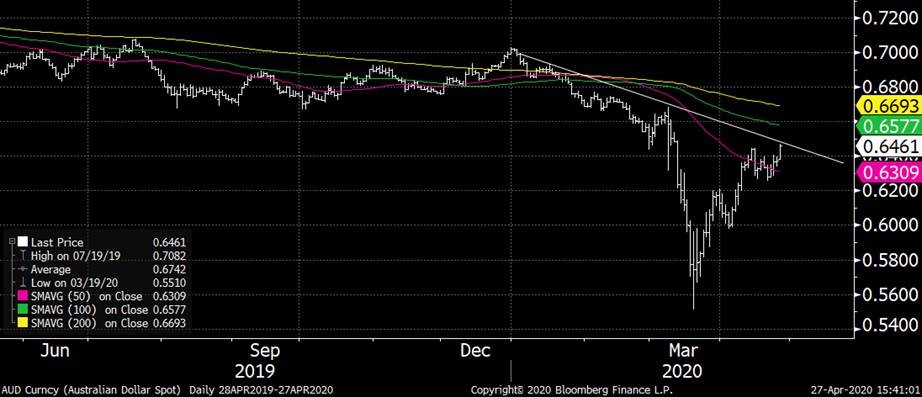

AUD is pretty much as resistance levels post new highs. Next resistance is at 0.6577 then 0.6685.. .which ties in with the 200dma that suppressed AUD through most of 2019 at 0.6693. It’s a big move back from 55c, but we’re starting to look at currencies on a relative basis.

AUDUSD

Contact the Inside Track Research Team for more info: +61 2 8916 6115