Market Update: 9 June 2020

As Non-Farm Payrolls sets the scene for June with an actual GAIN of 2.5m jobs and Unemployment fell to 13.3% from 14.7%, it was no surprise to see a 3.8% rally since Friday and as such gave risk a boost.

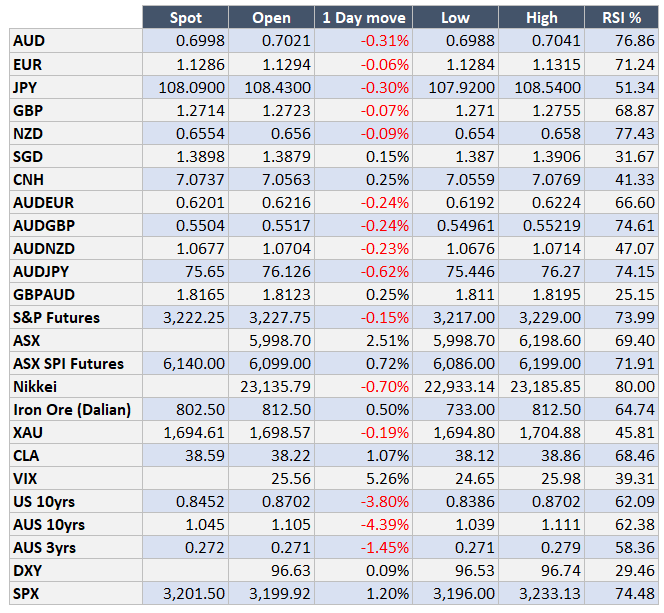

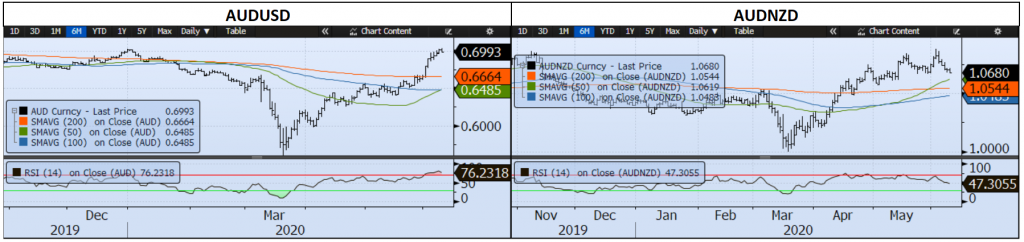

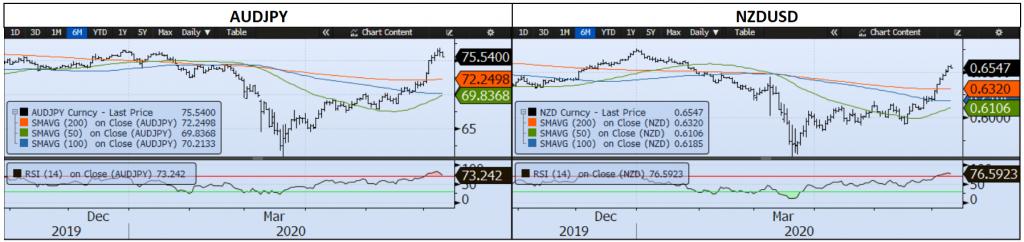

It does remain to be seen how sustainable things are as we see S&P in the overbought territory (as it breaks to Jan levels), whilst AUD continues there, breaking to new highs above 70c and through the Dec 19 highs all the way to 0.7041. Whilst some profit taking has emerged through the day, either we need a technical sell indicator – like the RSI or a downturn in data/increases of COVID cases to change mindset.

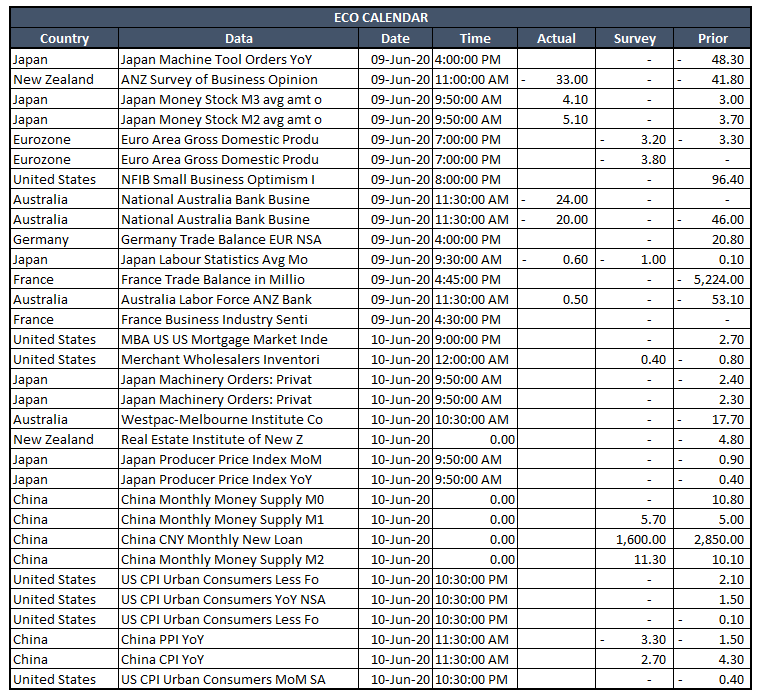

We do however have the FOMC early on the 11th. The “whatever it takes” mantra will likely still persist, it’s fairly obvious negative interest rates would be firmly off the table for now. I don’t expect there’ll be anything ground-breaking for now accept acknowledgement of the progress.

If we’re to talk further risks, given the ongoing barrage of buyers strike from China – now including tourism (not that it could happen anytime soon), the thing which brought the markets to this point is stimulus… could the punchbowl be taken away anytime soon? We have seen childcare as a limited period and Job Keeper could too end up with a limited shelf-life. We’ve also seen a medium-term program by the way of building/renovation, but it’s so highly conditional that it won’t be vastly stimulating for the economy. Of course, it’s not just an Australian story… Fiscal Policy globally may go as quickly as it came.

As New Zealand heralds the end of COVID – an amazing feat that plenty of countries would be extremely jealous of, their risks of local consumption will no longer need questioning, but it will still be the reliance on trade. They certainly sit prettier with China than Oz does, but tourism is still a major component and you wouldn’t expect borders to open so rapidly – unless they rope off a section of the Remarkables? Nonetheless, this should give AUDNZD a push lower and the idea of negative rates there (for now) should be swept aside.

On COVID, as Brazil becomes the 2nd largest for cases and sadly, well on its way for deaths, the comments about China needing us as much as we need them will come back in debate. With China’s continued protein shortage and Brazil having to slow supply both in agriculture and Iron Ore, perhaps there’s at least a bargaining chip on the table?

Contact the Inside Track Research Team for more info: +61 2 8916 6115